- Speed — Sub-second fills with optimistic execution

- Cost — Minimal overhead on top of raw transfers

- Capital Efficiency — Flexible batching for maximum inventory re-use

- Coverage — Works on any chain, with minimal effort to deploy to new chains and VMs

- UX — Simple transfer flows + fast reverts

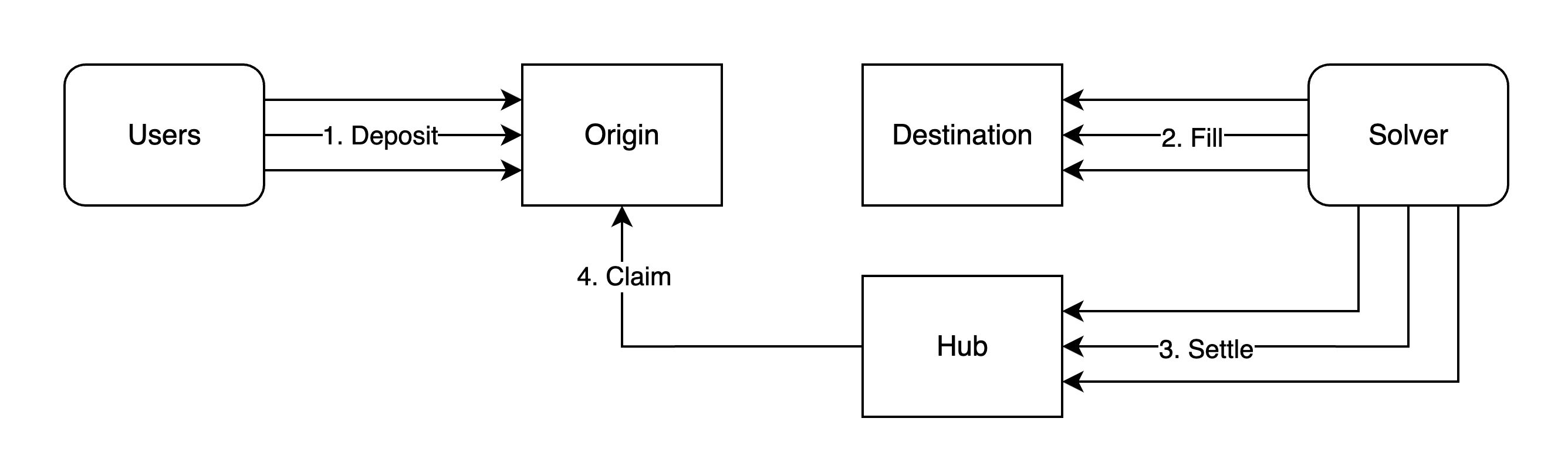

How It Works

Relay Settlement works similarly to other crosschain intent protocols:- User locks funds on the origin chain

- Solver fills the intent on the destination chain

- Solver proves fulfillment, to unlock payment

Speed

Relay is designed for sub-second fill times in production. Several design choices enable this:- Optimistic execution — Solvers fill orders before origin chain finality, taking on minimal confirmation risk for recent blocks

- No auction delay — There is no orderflow auction or solver competition window. Solvers receive orders and fill immediately.

- Instant settlement — The solver’s Hub balance updates as soon as the Oracle attests the fill, giving solvers confidence to fill aggressively without waiting for batch cycles

Cost

Crosschain intent systems can consume significant gas: passing order objects in calldata, verifying correct fulfillment, tracking intent status, emitting events. These might seem insignificant in an age of abundant blockspace, but add up in aggregate. Any gas paid is a wholesale cost that comes out before the solver’s margin. Relay keeps gas consumption to an absolute minimum, as close to raw transfers as possible:- ~21,000 gas deposits — Users pay close to a raw transfer cost (vs ~77,000 for typical escrow)

- Zero-overhead fills — Solvers can fill with a simple transfer, no contract interaction needed on destination

- ~$0.005 settlement — Orders settle on a dedicated low-cost chain, not the origin

Capital Efficiency

A core concern for solvers is getting paid as quickly as possible, in order to re-use capital for future orderflow. Claiming payment for every intent on the origin can be expensive, so most high-volume solvers want some form of batching. But not all batching is the same — some protocols globally batch all intents on an hourly interval, resulting in significant capital lockup. Relay Settlement allows solvers to withdraw whenever they want, choosing their optimal point on the trade-off spectrum between cost and capital efficiency. Settle thousands of orders in real-time on the Hub, and batch withdrawals on your own schedule.Coverage

Relay can work on any chain, and deployment to new chains and VMs is designed to be as simple as possible — so it can be ready day 1.- Heavy logic is shifted to the Hub, so each new VM is a small module

- Pull-based verification allows oracles to watch more chains with fewer resources

- No dependencies on specific EIPs, precompiles, or advanced RPC methods

UX

Too many protocols prioritize protocol simplicity over end-user simplicity. Relay’s philosophy is different — if there’s any opportunity to reduce user friction, it takes it, even at the expense of protocol complexity. Deposit UX Users don’t want to make two transactions to approve and deposit. Gasless flows can be great, but shouldn’t be forced on users with gas. Relay allows depositing via a simple transfer, for both native and ERC20 tokens — a UX that can compete with centralized exchanges. Failure UX For most intent protocols, failures are an afterthought. If something goes wrong, the user has a path to collect their funds out of escrow once the order has expired. In a world where prices move fast and items sell out, this is unacceptable. Relay allows solvers to instantly revert once they determine an order can’t be filled.Source Code

All protocol components are open source on GitHub:settlement-protocol— Hub, Oracle, and Allocator contractsrelay-depository— Depository contracts (EVM + Solana)